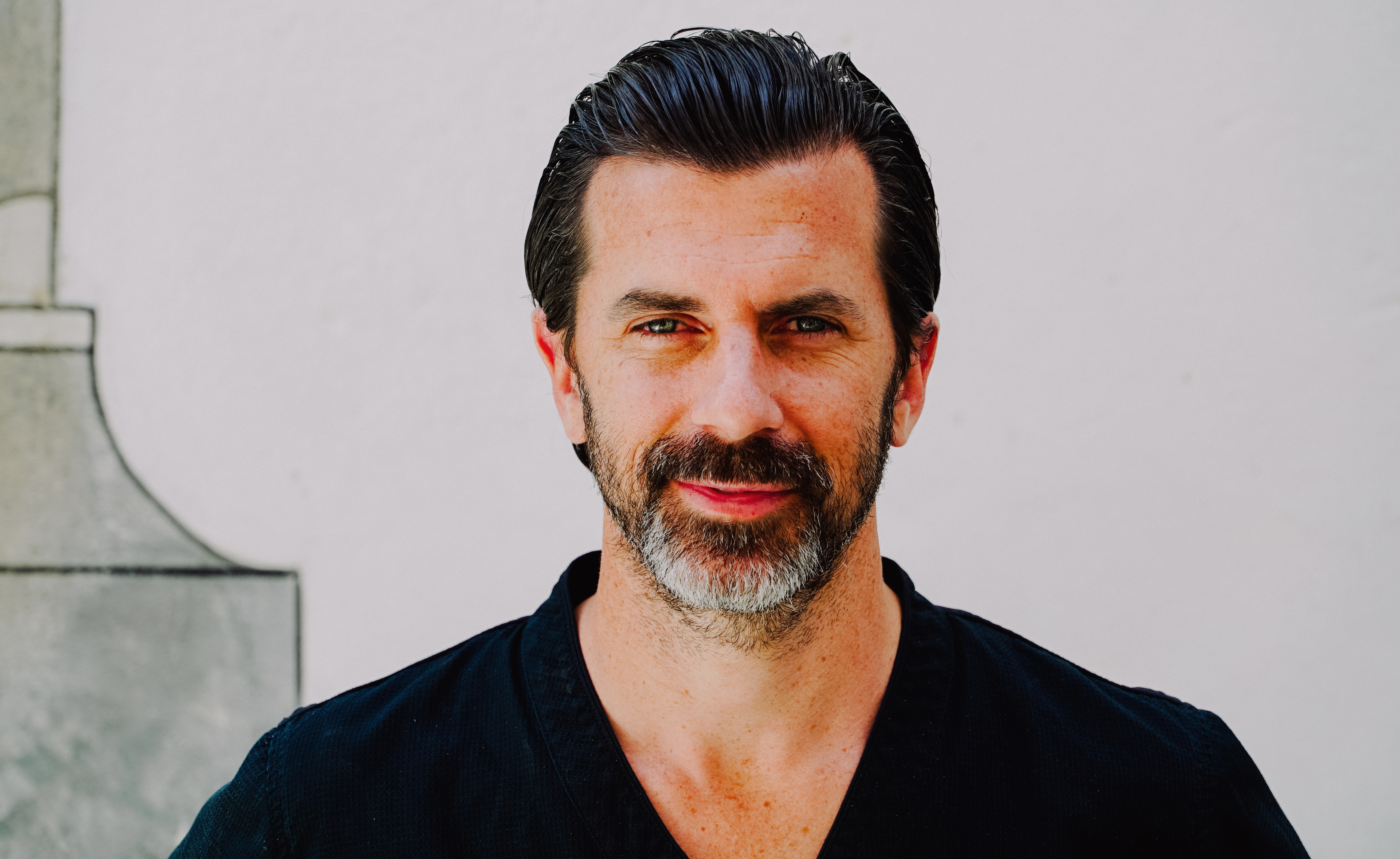

Hey, my name is Norbert

I’m an award winning journalist, digital content specialist, filmmaker and video editor based in The Netherlands. I focus on creating social media content mostly in gastronomy and culture.

With a background in broadcast journalism at RTL Network, my goal is to capture human stories and bring them to life through my videos and photos. My skills in directing, filming, editing, and online media management allow me to handle all aspects of digital content production.

In 2021, after my participation in the MasterChef TV show, I launched my personal brand and YouTube channel, attracting 191.2K viewers in the first week. Since then I also offer influencer marketing on my social media channels.

Feel free to contact me for more information or to discuss collaborating on your next project.

#content #socialmedia #video #photo #gastro

︎︎︎ instagram ︎︎︎ linkedin ︎︎︎ curriculum vitae ︎︎︎ interview

Launch Reels campaign for a Swiss fishmonger

Launch Reels campaign for a Swiss fishmongersocial media content, photography

Proudcing a 10-part Instagram Reels series for a new Swiss company, Original Fish. The project showcases my expertise in creating engaging gastro videos and photos. These content enhance the brand's social media presence. #format #content #film #photo

︎︎︎ read more

Influencer marketing possibilites

Influencer marketing possibilitesinfluencer content, social

Creating a unique and engaging online presence is essential for new business opportunities, especially in the culinary world. By leveraging platforms like YouTube and Instagram, I offer brands to connect with my audience through innovative content and influencer marketing. #content creation

︎︎︎ read more

S. Pellegrino & Bottura’s gala dinner

S. Pellegrino & Bottura’s gala dinner

filmmaking, photography

In Milan filming the Dutch team for the S. Pellegrino Young Chefs Competition, where young talents compete globally. Filming a gala dinner hosted by Massimo Bottura, a luminary in the gastronomic world. #content #film #photo

︎︎︎ read more

New Chefs on the Block

New Chefs on the Blockconcept, content, filmmaking, social

Developing a prize with Gaullt&Millau. “New Chefs on the Block” is a quarterly event based on my documentary movies recognising young talents in high-end gastronomy since 2019. #community #account management

︎︎︎ read more

Food Reporter

Food Reporter

art direction, branding, filmmaking

Responsibility for end-to-end concept and content creation in the high-end food segment. Food Reporter is a B2B multimedia platform created for chefs, food experts and suppliers in The Netherlands. #e-commerce #content marketing

︎︎︎ read more

Norbert in the kitchen

Norbert in the kitcheninfluencer marketing, content, social

Creating my personal brand and YouTube channel after participating in MasterChef tv show in Hungary in 2021. In parallel, international topics are available in English as Norbert in the Kitchen. #content #brand strategy

︎︎︎ read more

Masterchefs portraits

Masterchefs portraitsjournalism, filmmaking, video editing, photography

Since 2017 I’ve been travelling around Europe and filming three Michelin starred chefs. My portraits show the humans behind this tough profession. #content #film #photo

︎︎︎ read more

Road movie in South-Africa

Road movie in South-Africaphotography, video content creation

Creating a photo and videoreport about a study tour in South-Africa. As a “camjo” I’ve documented for a year the birth of a new restaurant called SAAM near Amsterdam. #content creation

︎︎︎ read more

Food Reporter app & on-demand

concept creation, art direction

︎︎︎ read more

Retail videos for FrieslandCampina

filmmaking

FrieslandCampina launched a new brand producing milk products for professional and home baristas. We created how-to videos for their B2B and B2C network. #retail

︎︎︎ read more

ZO Schoon crowdfunding video

filmmaking, video editing, photography

Supporting sustanibility by directing and editing a crowdfunding video for a dutch company which developed plastic-less cleaning products. #retail

︎︎︎ read more

The Dutch Seasons teaser video

The Dutch Seasons teaser videoconcept, filmmaking, video editing

Creating a concept video for the former three Michelin starred restaurant, De Leest. It promotes modern dutch gastronomy worldwide. #teaser #voiceover

︎︎︎ read more